Our History

Since our origins in 1960, Dermody has successfully acquired and developed logistics and industrial facilities, as well as build-to suits, for many individual clients in top national markets. As a leading industrial developer, owner and operator, Dermody employs a team of experts with decades of experience in strategic acquisition and asset management.

After doing business for over 60 years, the company’s past and current client list reads like a Who’s Who in Corporate America, including many Fortune 500 and Global 500 companies: Allen Distribution, Amazon, Arvato, Best Buy, Boeing, CAE, Conair, Costco Wholesale, Electrolux, Emerson, FedEx, Ford, Grainger, Jabil, Kenco Logistics, Kellogg’s, Ken’s Foods, LKQ, Mainfreight, Marmot, Medline, Mondelēz International, NFI Industries, National Tree Company, Niagara, Office Depot, OluKai, Omron, Panasonic, Patagonia, Penske, PepsiCo, Porsche, Pratt Industries Inc., Red Bull, Ryder, The Home Depot, TJX Companies, Uline, UPS, Wayfair, and many more.

From the very beginning, we have lived and breathed our Mission Statement: To create satisfied customers by providing responsive service and innovative real estate solutions, thereby sustaining long-term relationships and customer referrals.

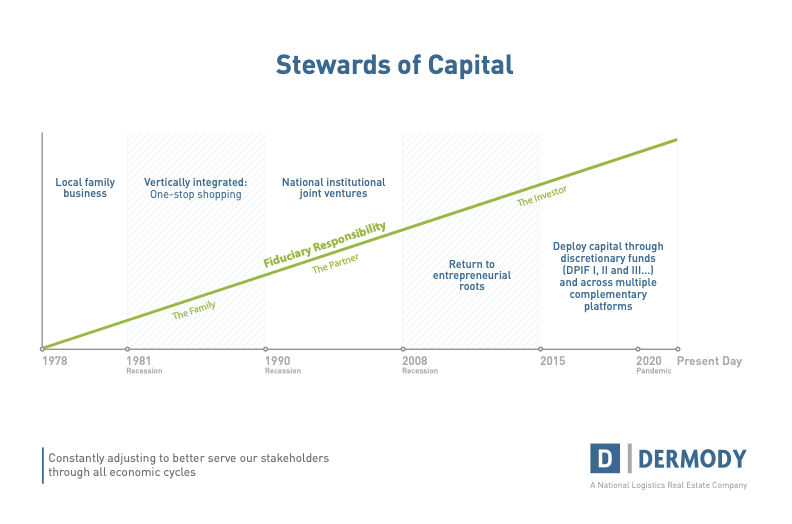

The thread throughout the company’s history is its diligence as stewards of capital; for the family business at its beginnings, for institutional partners such as CalSTRS and CalPERS, for the company's national growth between 1990 and 2007, and for new investors from 2008 onward–the pinnacle of which was the creation of Dermody Properties Industrial Fund I, Dermody Properties Industrial Fund II and Dermody Properties Industrial Fund III. These funds were unique, completely discretionary, value-added funds for long-hold investments, totaling approximately $2.2 billion – again demonstrating investors' confidence in Dermody's stewardship of capital.

-

1960

The Company is Founded

Successful local businessman, John A. Dermody, brought his family to Reno, Nevada, in 1950, when he was offered the regional franchise for the Philco Appliance Company. By 1960, he sold the appliance business but kept the building, became a landlord, and turned his attention to warehousing and distribution. From this modest beginning sprang a regional distribution hub. By 1960, John, a charismatic salesman, attracted the first New York Stock Exchange company, Bigelow Carpet, to Reno/Sparks. The Reno/Sparks area's close proximity to California (the eighth largest economy in the world) and its central location in the Western United States, quickly made it a leading hub for West Coast distribution.

-

1976

Michael Dermody Joins the Firm

Michael Dermody, a graduate of the Gonzaga School of Law, joined his father's two-man company, John A. Dermody, Inc. - already the preeminent industrial developer in the region.

-

1978

Key Partners are Added

Quickly recognizing that the best way to grow the business was through great customer service, Michael began to vertically integrate the company and, as a result, formed United Construction Company and D&D Roofing with key partners who were as committed to quality and customer service as he was. As Michael would say, "The two biggest problems that you can have in a building are the floor and the roof." Michael and partner, Tony Taormina, formed what would become one of the largest industrial construction companies in Nevada when they created United Construction Company (UCC). The company gained tighter control over product quality and delivery for Dermody Properties' customers. UCC and Dermody Properties remain partners and still provide outstanding customer service. As Tony Taormina says, "It’s where the promises are kept." In 1979, the company developed its first speculative building, which was a big step beyond its already-successful build-to-suit (BTS) business. This platform was the beginning of what would become a long history of BTS and speculative development through well thought-out market selection, timing and judgment. This conservative strategy would be seen again and again in the years to come.

-

1982

Michael Dermody Becomes CEO

As the company grew and became diversified, Michael Dermody became President and CEO, and its name was changed to Dermody Properties. Michael would grow the company in a different direction, never forgetting his father's legacy that enabled him to begin his journey.

-

1983

Market Share Grows

Vertical integration continued, providing opportunities to assist clients with financing, construction, development, and leasing under one roof. After the recession of 1981, with fewer developers in the market, the company emerged with almost a 50% market share. This more diverse portfolio, was made possible through its innovative approach of one-stop shopping for clients and enabled Dermody Properties to assist more national clients. Dermody could provide “under one roof” leasing services, land control, financing and construction. This vertically-integrated model would eventually be followed by other developers nationally.

-

1985

First Master-Planned Business Park

The company built its corporate headquarters based upon unparalleled customer service and one-stop shopping under one roof. At the same time, it began developing its first master-planned business park on 200 acres acquired from the University of Nevada, Reno.

-

1988

Dermody Properties Foundation is Created

The company officially formed the Dermody Properties Foundation, to put into place a structure and process to give back to the communities in which it does business. The Foundation was funded by the profits generated by the hard work and dedication of all employees at Dermody Properties. Funding decisions are made by a committee of employees each year. With a focus on the arts, education, and family, as well as a special emphasis on children and the elderly, the employee-managed Foundation provides on average more than $100,000 in donations per year to various organizations, and has in its first 10 years of operation, donated more than $2 million in funds to more than 230 worthy non-profit organizations and community causes.

-

1990

Institutional Partnerships Fuel Growth

Michael Dermody purchased his family's ownership in Dermody Properties and led the strategy of seeking institutional partnerships to help fuel the growth that the company would see in the next 15 plus years. Michael steered the company into a 14-year strategic partnership with the California Public Employees’ Retirement System (CalPERS), the largest public pension plan in the country, and the largest with investments in both domestic and international markets. This unique equal partnership was ahead of its time, for a modest, private development company like Dermody Properties, to partner with a large public pension fund. The partnership with CalPERS consistently earned above-average industry returns for the 14-plus years it existed. As Dermody Properties expanded its national presence, it would create additional financial platforms with other major partners, including the California State Teachers Retirement Fund (CalSTRS), and Lazard Frères & Co. These institutional partnerships became the springboard for expansive national growth by bringing flexible financing options to match the ever-changing needs of its real estate clients. Clients appreciated Dermody’s creativity and this, in turn, sustained many long-term relationships still enjoyed by the company today, thus continuing Dermody Properties' longstanding history as stewards of capital.

-

1992

Dermody Properties Remains Privately Held

Dermody Properties, like many in its industry, investigated the option of going public. However, consistent with its philosophy, it chose to maintain its high level of customer service as an entrepreneurial, privately-held development company.

-

1995

Customer Partnerships and Alignments Fuel National Expansion

In a rebounding economy, Dermody Properties had by this time, developed major distribution facilities on the West Coast, in the Midwest and in the Mid-Atlantic, thereby being able to serve customers nationwide. Dermody Properties hit its stride of developing 3 million square feet per year. Contributing to its national expansion was its laser focus on customer service; one of its long-time clients, Owen Distribution Company (ODC), grew into a large, national, third–party logistics (3PL) company. As ODC expanded across the country, its landlord and partner–Dermody Properties–expanded with them. This was also true of Merck’s expansion to the Mid-Atlantic region; it was a matter of months before Dermody Properties then opened an office in the region. And when Sherwin-Williams entered Georgia in 1986, Dermody Properties had a team nearby to support its expansion. Customer service and relationships remain paramount to Dermody Properties today.

-

1997

National Expansion Continues with Lazard Frères & Co.

Dermody Properties aligned with financial leader, Lazard Frères & Co as it continued to grow its coast-to-coast industry platform.

-

2003

Historical Joint Venture with CalSTRS

Dermody Properties created a programmatic joint venture with the California State Teachers Retirement System (CalSTRS). CalSTRS, already an investor in the Lazard Frères Opportunity Fund, wanted to create its own national industrial portfolio and turned to Dermody Properties. At that time, it was the largest real estate transaction done in the history of CalSTRS.

-

2004

LogistiCenter® Concept is Born

Understanding that the flow of logistics is the core of quality industrial development, Dermody created the LogistiCenter® brand. It represents the essence of quality distribution, where infrastructure, demand and customers meet. Today, LogistiCenter® is a national brand, a registered trademark, owned and developed by Dermody Properties. It represents the company’s business philosophy for meeting Corporate America’s supply-chain requirements for Class A industrial distribution facilities, including warehouses, manufacturing, assembly, processing, and research and development.

-

2007

Landmark Portfolio Sale to ProLogis

Dermody Properties makes national news when it sells its portfolio of 25 million square feet to Prologis (NYSE: PLD). The powerful alignments that Dermody Properties forged created this significant portfolio, and the sale was the largest transaction done in the history of CalSTRS. In retrospect, his transaction would be especially significant in real estate history, given the unanticipated national economic recession that would begin within a few months after the event. Never content to rest on its laurels, the Dermody Properties team retained 518 acres of land from its portfolio and continued to serve its customers from its four original offices in Portland, Oregon; Reno, Nevada; Chicago, Illinois; and Philadelphia, Pennsylvania. The 518 acres of entitled, development-ready land would become the foundation of its new growth in the future. The organization pursued a more flexible, entrepreneurial style of development. These Dermody Properties' offices would, in turn, become regional headquarters for the company’s Northwest, West, Midwest and East Regions, respectively, to manage national portfolio and development efforts.

-

2008

First Annual Thanksgiving Capstone Award

Dermody Properties creates its annual Thanksgiving Capstone Gift in the Great Recession. Responding to the even greater needs of families, the program provides a major gift to a non-profit organization each year. Recipients are determined by the company’s executive management team. The Dermody Properties Foundation remains entirely managed by all Dermody Properties employees. The first year’s gift was $25,000 to the Food Bank of Northern Nevada. Each year since, it has provided financial gifts to very effective – and deserving – non-profits.

-

2010

Company Emerges as Post-Recession Leader

As Dermody Properties clearly emerges as a post-Recession national leader, partnerships with local governments, financial organizations, economic development organizations and others continue to expand, benefiting all involved in each alliance. More than ever, the challenging economic times demand unsurpassed customer focus and the Dermody team’s 35-plus-year history of excellent customer service has created a foundation on which to go forward. Dermody creates a joint venture with the financial firm, Great Point Investors, LLC, who is advisor for Ohio Public Employees Retirement System (OPERS). This development, centered around LogistiCenter® at Logan, in New Jersey, created a number of successful leaseholds and real estate transactions, including the 1-million-square-foot Amazon facility in 2016.

-

2011

Douglas A. Kiersey, Jr. Joins as President

Douglas A. Kiersey, Jr. joins Dermody Properties as President of the firm, with the responsibility of managing the company's capital, acquisition, development and property management activities nationwide. Mr. Kiersey joins Dermody Properties after 27 years in the industrial development industry. His extensive public company background and market knowledge dovetail perfectly with Dermody Properties' private company background and market exposure to create a best-in-class private platform.

-

2013

Southwest Region Office Opens

Dermody Properties establishes a Southwest Region office in Phoenix, Arizona to better serve the southwestern United States. Patrick Gallagher was brought on as a partner to lead Dermody Properties' ambitious industrial and office development program, focusing on Phoenix as well as the Denver, Texas and Southern California markets.

-

2016

Timothy Walsh Joins as Partner, Chief Investment Officer

Timothy F. Walsh joins Dermody Properties as Partner, Chief Investment Officer. Mr. Walsh is based out of the Midwest Region Office in Chicago where he is responsible for the company's acquisition and investment opportunities nationwide.

-

2017

National Industrial Developer Dermody Properties Expands to Southern California with Acquisition of 75,960 SF Facility

Dermody Properties acquires the Bloomfield Industrial Center located in Santa Fe Springs from a private investor. Located at 10712-10748 Bloomfield Ave. this 75,960-square-foot warehouse and distribution facility marks Dermody Properties’ first offering in the Southern California area.

-

2017

Dermody Properties Industrial Fund (DPIF I) Closes

Dermody Properties Industrial Fund (DPIF) I – the company's first co-mingled fund – closes at $442.4 million.

-

2018

Kathleen Briscoe Joins as Partner, Chief Capital Officer

Kathleen S. Briscoe joins Dermody Properties as Partner, Chief Capital Officer. Ms. Briscoe is responsible for all aspects of the company’s capital strategy and execution, including asset management, institutional capital raising activities, structuring of commingled funds and joint ventures.

-

2018

Elizabeth Kauchak Joins as Chief Operating Officer

Elizabeth Kauchak, 18-year industrial real estate veteran, joins Dermody Properties as the company’s Chief Operating Officer. Ms. Kauchak is primarily responsible for leasing, property management and capital programs for Dermody Properties’ robust and expanding portfolio.

-

2018

Dermody Properties Industrial Fund (DPIF II) Closes

Dermody Properties Industrial Fund (DPIF) II – the company's second co-mingled fund – closes at $619.3 million, exceeding the target fundraising goal of $600 million. One hundred percent of first fund investors committed to DPIF II.

-

2019

Atlanta Office Opens in the Southeast Region

Dermody Properties grows its national footprint and establishes an Atlanta office to serve the Southeast Region.

-

2019

Matt Mexia Joins as Partner, Southern California

Matt Mexia joins Dermody Properties as Partner, Southern California to manage properties in the southern part of the state. In this role, Mexia is responsible for sourcing and executing acquisition and development opportunities in Southern California, consistent with Dermody Properties’ strategy of acquiring and developing Class A logistics facilities in infill submarkets.

-

2019

Nevada Region is Formed, John Ramous joins as Region Partner

Dermody Properties forms a new region in Nevada and John Ramous is hired as Partner, Nevada. George Condon, West Region Partner, hones his focus on Northern California.

-

2020

Neal Driscoll is Hired as Midwest Region Partner

Neal Driscoll joins Dermody Properties as Midwest Region Partner, responsible for the company’s expanding portfolio across the Midwest Region including the pursuit of acquisition, development, redevelopment and build-to-suit opportunities.

-

2021

Dermody Properties Industrial Fund (DPIF III) Closes

Dermody Properties Industrial Fund (DPIF) III – the company's third co-mingled fund – closes at $1.1 billion, exceeding its target fundraising goal of $800 million. Nearly all the first and second fund investors committed to DPIF III, along with significant new investors.

-

2022

Rob Borny, CCIM, is named East Region Partner

Rob Borny is named East Region Partner and is now responsible for all land and building acquisitions, build-to-suit projects, development activities and asset management in New Jersey, Pennsylvania, Delaware, Connecticut, New York, Maryland and Virginia.

-

2022

Benjamin Seeger joins as Northwest Region Partner

Seeger is responsible for the sourcing and execution of acquisition and development opportunities in the northwestern United States. He also leads asset management and customer relations for the region.

-

2022

Amy Curry Joins as Partner, Chief Strategy Officer

Amy Curry joins Dermody Properties as Partner and Chief Strategy Officer, bringing with her more than 22 years of logistics real estate experience to the role. She is responsible for the growth of the company’s existing and future investment platforms.

-

2022

Wes Hardy Joins as Southeast Region Partner

Hardy is responsible for the sourcing and execution of acquisition, development and redevelopment opportunities throughout the Southeast, consistent with Dermody Properties’ strategy of acquiring and developing Class A logistics facilities in infill submarkets. He also manages the existing portfolio through asset management and customer relations for the region.

-

2023

Douglas A. Kiersey, Jr. is named CEO in addition to his role as President

In this role, Kiersey continues to oversee all company operations and strategic initiatives including capital formation, acquisition, development, and investment management activities. He is a member of the Dermody Properties Advisory Board and chairs the company’s Executive and Investment Committees. Mr. Dermody remains Chairman of the Advisory Board and will continue his day-to-day responsibilities as a member of the Executive Committee and the Investment Committee, while continuing his long-standing protocol of signing every lease as part of the company’s customer-based mission.